An Apocryphal Wall Street Story

A broker recommends a small, thinly traded stock.

It goes up. The client is happy.

“Buy a little more,” says the broker.

It goes up again.

And again. Each time, they buy more.

Months later, the client owns a mountain of stock.

The price has soared.

Feeling brilliant, he calls the broker.

“Let’s sell and take our profit.”

The broker pauses.

“To whom? You’ve been the only buyer for the last 50 points.”

That story, once apocryphal, is quietly becoming true, only on a much larger scale.

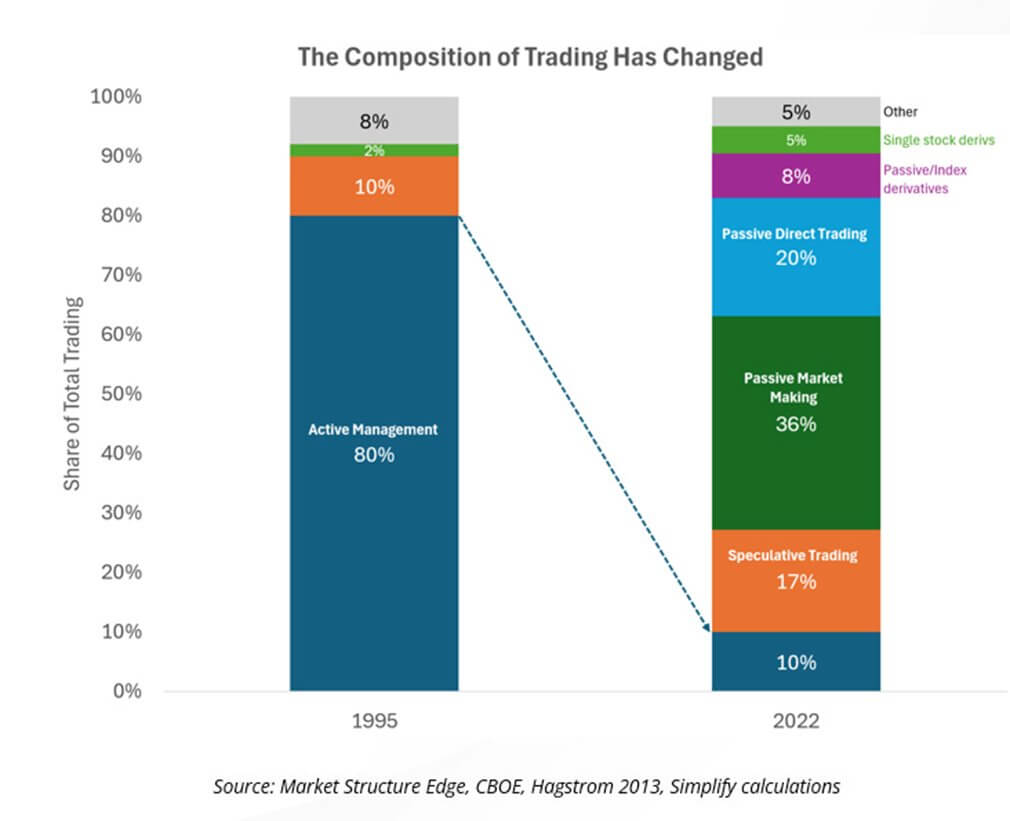

In 1995, active managers accounted for roughly 80% of all stock trading volume.

These active managers were the clients of firms like Robertson Stephens, where I was a partner during the heyday of the sales, trading, research and underwriting business in the 1990s.

By 2022, that share had fallen to just 10%.

With passive capital now driving up prices and drawing investment toward the largest stocks, can companies still rely on the traditional sales, trading, research, and underwriting model to find real investors when raising capital?

That’s why we developed the Option Dividend Strategy.

It bypasses the old financing model to raise capital on a pro-rata basis directly from a company’s own shareholders, rewarding them with free options, rather than diluting them.

A better outcome for our clients, we believe, than even during that heyday we all fondly remember.