A Bubble That Broke The World

The terms specified the American children of the lenders would be repaid by the Japanese children of the borrowers.

“Dwight W. Morrow, formerly of the house of J. P. Morgan and Company, international bankers; then Ambassador to Mexico, later United States Senator, once counted the foreign bonds listed in a daily bond table in a daily newspaper; the number was 128, where ten years before there had been only six.

The contemplation of the extent and variety of America’s investments in foreign bonds gives rise to three questions: Who buys these bonds? Why do they buy them? What do they get when they have bought them?

In 1924, 40 persons in a western city put $100 apiece into a Japanese bond maturing in 1954. What did those people get for their money? They got a promise.

More than four buyers in every five were schoolteachers and army officers and country doctors and stenographers and clerks, people who spend less than they produce and who create a fund for future use. People who could have bought something that day but did not, because they wished to do something with their money later.

They got a promise. And, mark you, that promise was the promise of a group of people associated together on the other side of the earth. Moreover, so far as the promise relates to the payment of the principal of the bond, the promise does not mature in time to be kept by the particular members of the group who originally made it. It is a promise designed to be kept by the children of men now living.

Yet somehow or other, the banker who offers that bond and the investor who buys that bond rely on the people of Japan taxing themselves a generation from now in order to pay back the principal of that bond to the children of the person who invests in the bonds today. At first blush it is a startling idea.

When the crystal burst, the loss upon American investments abroad was incalculable. More than eight hundred million dollars of these issues sold to the American investor within five or six years at ninety, ninety-five and one hundred were in default.”

NYT Article🔗 – Feb. 13, 1924

“Three Japanese financial experts stepped into the library of J. P. Morgan in Thirty-sixth Street, just east of Madison Avenue, and were ushered into a reading room where they were greeted by eight of America’s prominent financiers. The time was 10 o’clock at night. Fifteen minutes later the three Japanese, in company with their American hosts, emerged and the announcement was made that $150,000,000 Japanese Government bonds would be offered here by American bankers.“

Time Magazine Article🔗- Feb. 18, 1924

Said one negotiator: “For 2,584 years the Japanese Empire has paid all its obligations, and we don’t need to entertain the slightest worry about her ability to continue paying her bills over the next ten, twenty, fifty or a hundred years.”

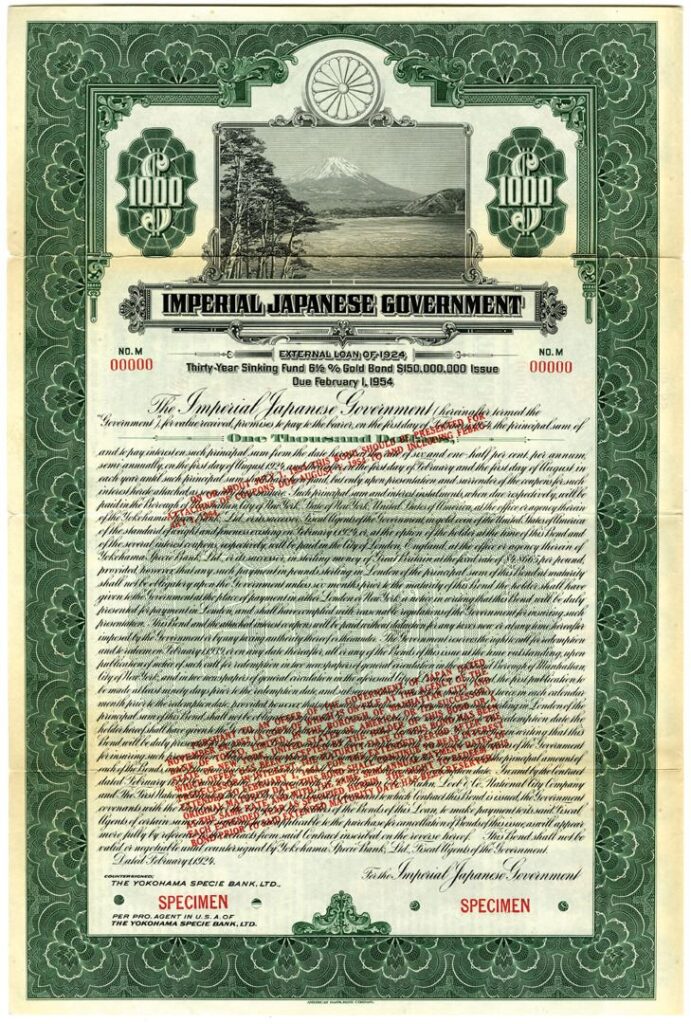

The Bond

We have found the bond specimen below, which appears to be the original bond referenced in the book. (Source) However it has not been independently verified by any official archive or authentication service. It is provided purely for educational and historical discussion purposes only, with no warranty of any kind.

IMPERIAL JAPANESE GOVERNMENT

External Loan of 1924

Thirty Year Sinking Fund 6 1/2 % Gold Bond $150,000,000 Issue

Due February 1, 1954

(Disclaimer: This transcription is provided for reference only and may contain minor inaccuracies or omissions due to the age, condition, or ornate styling of the original document.)

The Imperial Japanese Government (hereinafter termed the “Government”), for value received promises to pay to the bearer, or if registered, to the registered holder, the principal sum of One Thousand Dollars on the first day of February 1954, and to pay interest thereon at the rate of six and one-half per centum (6½%) per annum semi-annually on the first day of February and the first day of August in each year until payment of said principal sum, both principal and interest being payable in gold coin of the United States of America of or equal to the standard of weight and fineness as it existed on February 1, 1924, at the office of The Yokohama Specie Bank, Ltd. in the City of New York, or at the option of the holder in the City of London, England, in sterling money at the fixed rate of £205 13s. 5d. for each $1,000 of the principal amount hereof (the place of payment of interest being subject to change as hereinafter provided). This bond is one of an authorized issue of bonds of the Imperial Japanese Government known as its External Loan of 1924, amounting in the aggregate to One Hundred Fifty Million Dollars ($150,000,000) principal amount, all issued or to be issued under the same date and tenor and similarly secured. The Government covenants that it has caused to be set apart and will maintain a sinking fund sufficient to redeem by purchase or drawing, on or before the first day of February in each year commencing with the year 1927, bonds of this issue to an amount equal to two per centum (2%) of the maximum amount of bonds of this issue at any time outstanding, such redemption to be effected by the purchase of bonds in the open market when obtainable at or below par, or by lot as provided in the agreement hereinafter mentioned. This bond is subject to redemption in whole or in part at any time on or after February 1, 1934, at the option of the Government, on any interest date, at 105 per centum of the face value together with accrued interest to the date fixed for redemption. For the due payment of the principal and interest of the bonds of this issue and for the performance of all the covenants herein contained, the Government has entered into an agreement with The Yokohama Specie Bank, Ltd. as Fiscal Agent, dated February 1, 1924, to which agreement reference is hereby made for a statement of the terms and conditions upon which the bonds of this issue are issued and secured. IN WITNESS WHEREOF the Imperial Japanese Government has caused this bond to be signed in its name by its Minister of Finance and to be countersigned by its Consul General in New York, and its corporate seal to be hereunto affixed, and the interest coupons hereto attached to be authenticated by the engraved signature of its Minister of Finance, this first day of February 1924.